What Twilio’s $3.2B Segment Acquisition Means for the CDP Market

If you’re a marketing technology buyer, chances are you’ve heard of Segment. Their low-cost offering and enormous marketing budget have resulted in market-leading awareness, boosted demand and a unicorn valuation status.

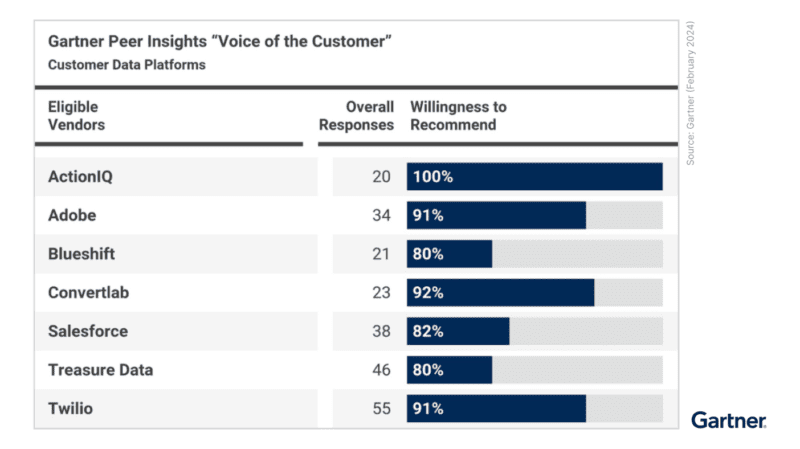

Recently, San Francisco-based Segment has doubled down on positioning itself as a Customer Data Platform (CDP) – even going as far as branding a whole week to their CDP. With the Forbes reporting on Friday, we learned that Segment just exited for $3.2B to cloud communication platform provider company Twilio. Congratulations are in order and we wish them the best. You’d be forgiven for wondering why Twilio bought them, versus one of the big acquisition-happy marketing clouds (Adobe, Salesforce, Oracle) who have been struggling to get their own CDP solutions out of the door for years now.

The reason is that Segment is more Pipe than Platform when it comes to CDP. They were even less of a business solution and much more of a developer toolkit. Finally, they were focused on integrating a 360 view of digital data but were not built to include other customer data sources such as offline, loyalty or call center data.

These are all fundamental aspects of their product and business that made them a very different “CDP” from, say, ActionIQ. Let’s take a closer look at what Segment’s product-market fit, and why it makes perfect sense cloud communications company Twilio is the perfect home for them (more on how this may be Twilios’s mid-market, dev-focused answer to Salesforce).

Product Fit (data piping for developers):

- Use Case: transferring digital data between siloed applications in real-time. To use an example, pretend you want to trigger an email to a customer who just abandoned their online shopping cart. Segment can automate that integration and push that data to an email service provider in real-time.

- Users: data engineers within IT departments who want to reduce the number of APIs that they need to develop in-house

Product Gap (the larger customer data problem set)

- Use case: creating a customer 360 replete with your full historical customer data., democratizing data to your business team for better and faster decisions, and providing robust omnichannel orchestration capabilities to all customer touchpoints

- Users: business users in roles within marketing, CX, demand planning, finance, eCommerce, and more. Basically, anybody that doesn’t know how to write SQL isn’t a candidate for Segment.

There are more details beyond these— particularly what type of stack Segment fits best into, and what type of organization should consider Segment. These are important questions— particularly during a pandemic economy.

So if you’re trying to understand the tradeoffs of various CDPs on your martech stack’s effectiveness, reach out to us and we will give you the full book. At the end of the day, the effectiveness of your customer tech stack is what’s most important as a technology leader, and will continue to require more than what Segment offers.