Explaining Twilio’s Acquisition of Segment

Friday’s announcement of Segment being acquired by cloud communications platform Twilio is going to leave a lot of people in the CDP space buzzing. With their unicorn status at last fundraise and massive marketing budget, they were one of the more visible vendors in the space. So what does a cloud communication company like Twilio need, enough to justify an impressive $3.2B acquisition price, in a company like Segment? To answer that, we must be honest about what Segment is and what it is not.

Segment, originally designed for developers struggling to manage application data across the stack, is great at moving data between applications in real-time. However, this falls short of a true smart-hub CDP, which should have the following three capabilities:

- A foundational data layer that can unite data from all sources online and offline, and create a single unified 360 view of the customer

- An intelligence layer providing insights on customer data, augmented by out-of-the-box ML

- An orchestration layer for connecting that data to every layer of the customer experience stack, across marketing and non-marketing channels.

Segment’s strengths are in the connection of digital data in creating the customer 360 layer, but fails to deliver on key capabilities such as identity management and provides minimal value across the other up-the-stack capabilities of a smart-hub CDP. And critically, Segment is designed largely for developers, not the rest of the business. It’s no wonder they originally positioned themselves as Customer Data Infrastructure (CDI), something that would sit below and feed data into a true CDP. In the end, that’s exactly what they were purchased for by Twilio.

This focus on developers will allow Segment to fit in nicely with Twilio’s target market and persona. In fact, Segment will likely provide a foundational layer to connect some of Twilio’s offerings, including their $2B acquisition of SendGrid, a developer-focused email platform. It seems Twilio is investing in tools to ensure their offerings are truly integrated with each other, something that other marketing clouds have consistently failed at with their acquisitions. In that light, the $3.2B price tag makes sense.

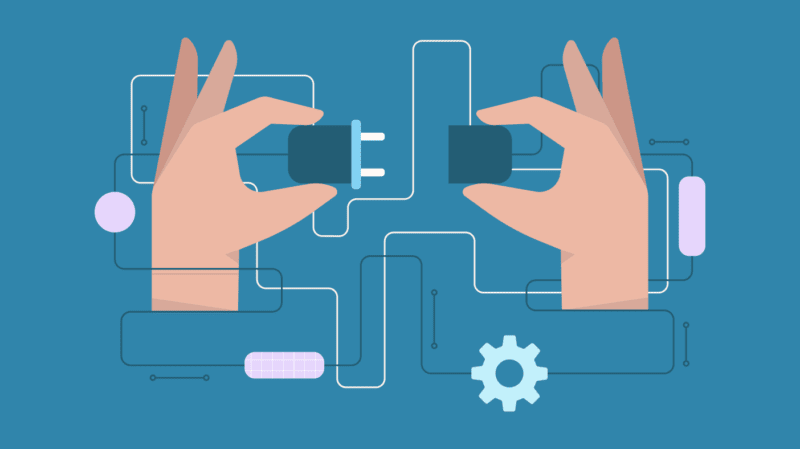

However, this developer focus falls short in delivering on authentic customer experiences, as an ability to provide tools accessible to the entire organization, and orchestrate customer experiences across every channel, not just marketing channels. Rather than delivering a full end-to-end smart-hub CDP, Twilio seems to be creating a perfect ecosystem for a smart-hub CDP to sit in the middle of. With Segment providing the CDI to move data into the CDP, and Twilio’s many best-of-breed cloud communications products providing the delivery systems for the marketing portions of the customer experience stack, a smart-hub CDP could be very complementary to their offerings.

The $3.2B acquisition of Segment, to solve primarily the CDI portion of the customer experience stack, shows how valuable this problem is for companies and how many companies are trying to address it.