Insights From The Forrester New Wave ™: B2B Standalone CDPs, Q4 2021

Over the past few months, research and advisory firm Forrester screened more than 30 customer data platforms (CDP) built for business-to-business (B2B) brands. Fourteen vendors were invited to a formal product evaluation, known as a Forrester New Wave ™. This evaluation includes briefings from vendors, interviews with their customers and a lengthy, request-for-proposal-style questionnaire.

The results of the Forrester New Wave ™ were recently published, and I’m excited to announce that ActionIQ was named a “Strong Performer,” in addition to being recognized as “strongest in segmentation and journey orchestration.”

But this is just the tip of the iceberg when it comes to understanding B2B CDPs. Read on to find out why this report is valuable for B2B brands and discover extra insights that will shortcut your path to success.

Take the Guesswork Out of Your CDP Evaluation With the Forrester New Wave ™

Optimizing a marketing technology (aka martech) stack is hard, and it’s even harder in the B2B world due to complex workflows and buyer journeys.

You can hear it directly from ActionIQ customers like Autodesk in the video below:

Forrester is helping you prioritize which technology to invest in by signaling that CDPs are a must-have in your stack. Analysts don’t spend precious hours grinding through technology evaluations unless they believe the technology provides near-essential value.

Long story short, Forrester is giving B2B brands a cheat sheet to choosing the right CDP. If you have to build an RFP, Forrester’s report could save you weeks (if not months) of research.

This means you can devote more time to following analysts’ advice of ensuring vendors’ capabilities line up with your business use cases.

Don’t Let Your CDP Be an Afterthought

If there’s one trick I learned during my years as an industry analyst, it’s that you can learn a lot about a technology from its heritage. When you know what something was built to do, you can speed up the process of understanding its strengths and weaknesses.

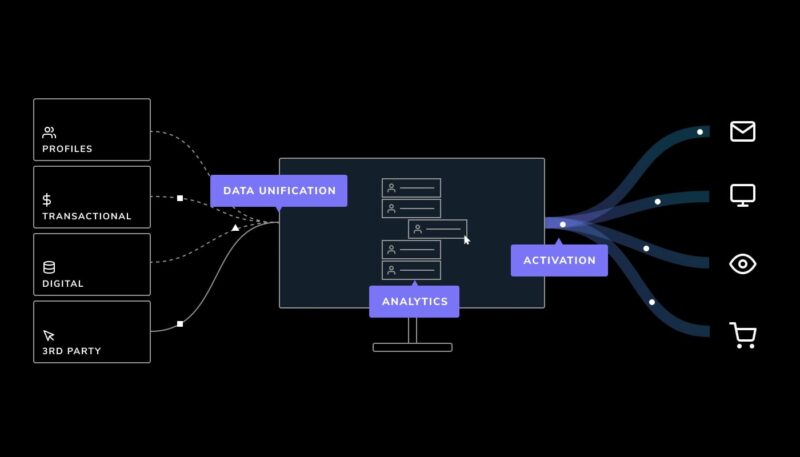

Watch the below video to get a quick refresher on which capabilities are most essential to a CDP:

After reviewing The Forrester New Wave ™: B2B Standalone CDPs, Q4 2021 evaluation, the best investment of your time will be understanding what problem each CDP was originally built to solve and what type of user it was designed for.

For example, the highest-scoring vendors in the report have a heritage in account-based marketing (ABM), selling data and applications designed for demand generation teams at B2B companies. They excel at collecting, enriching and analyzing business profiles.

But these vendors didn’t start as CDP providers. Due to customer complaints about the weak data management capabilities of ABM tools, as well as their struggles with scaling to millions of profiles for enterprise companies, these vendors decided to either buy a CDP (Terminus purchased Zylotech and Dun & Bradstreet purchased Lattice Engines, two CDPs designed for small and midsize businesses) or develop very basic CDP capabilities themselves (Leadspace).

The truth is that adding a CDP as a bolt-on to their ABM platforms is meant to help these vendors survive the deprecation of third-party cookies — and other types of user tracking, such as via IP addresses — which are the lifeblood of their platforms and what much of an ABM’s value depends on.

But as the experts at another leading analyst firm — Real Story Group — like to say, you shouldn’t buy a car based on its roof rack.

Avoid buying solutions from vendors who sell a CDP as an ancillary capability to their core offering. That advice goes double for enterprise businesses, which require greater levels of flexibility and scalability from their CDPs.

Curious about the benefits of selecting the right CDP? Check out the video below:

Recognize CDP Red Flags

Why should you be wary of vendors that bolt on CDP capabilities to existing technologies?

Look no further than marketing cloud vendors, which are incentivized to integrate their CDPs primarily with other tools in their portfolio. As industry analysts have pointed out, many of these CDPs’ critical features will only be available if you use the remaining tools in that specific portfolio.

But that’s not all. Remember that technology vendors want to hold on to their existing products, no matter how outdated, instead of throwing them away and starting from scratch. That means that when a new product is developed (such as a CDP), vendors are incentivized to ensure its capabilities don’t steal from their other tools.

The outcome is a CDP with only a subset of the capabilities a complete solution should offer, requiring you to buy other tools from that vendor in order to obtain all necessary features.

This is why the majority of marketing technology buyers prefer a best-of-breed approach. More significantly, it’s why these buyers report greater technology utilization and effectiveness.

Take it from ActionIQ customer M&T Bank, which explains why choosing the right CDP is so important in the below video:

3 Tips to Select the Right CDP With Confidence

So what’s a B2B brand to do in such a crowded and confusing market?

Here are three tips to help you make the right CDP selection (and avoid common pitfalls):

- Don’t fall prey to shiny object syndrome: Most B2C CDP vendors don’t prioritize data flexibility and scalability — the foundation of your long-term success. Instead, they prioritize shiny extras, such as out-of-the-box predictive models and real-time website personalization. But don’t be fooled. Remember that the success of any CDP feature depends on the foundation it’s built upon. If the solution doesn’t provide exceptional data flexibility and scalability, it’s like building a house on quicksand.

- If a martech vendor offers you their solution for free, run for the hills. It means the solution is underdeveloped and in need of credibility. Your company logo will become the marketing asset these vendors need to sell their first “paying” customer on it. The last thing you want to be is a guinea pig for some vendor working out the kinks of their undeveloped CDP. The old adage of “you get what you pay for” has never been more true than when applied to your customer data solution.

- No CDP vendor has a “perfect” solution, no matter how hard their marketing departments try to say otherwise. Follow the advice of industry analysts and make vendors show you, not tell you. Keep your vaporware detector on high alert and beware of any vendor that defaults to slideware instead of showing you their capabilities inside a production-level product demonstration. And for extra confidence, remember that the greatest indicator of vendor success is client retention rate. Just like a restaurant, people will only keep coming back if they enjoy what they’ve ordered.

Finally, as a prior practitioner and user of numerous marketing technologies, I’d like to say kudos to Forrester. It’s prioritizing helping organizations understand and evaluate the CDP landscape — a major task given how wide-ranging it is. Forrester deserves a ton of credit for prioritizing brands’ education.

Learn More

To learn why ActionIQ was recognized as a “Strong Performer” by Forrester, download the report: The Forrester New Wave™: B2B Standalone CDPs, Q4 2021.