3 Ways Financial Services Brands Can Thrive and Future-Proof Their Stack

Regulations surrounding third-party cookies continue to change and in order to ensure continuity, especially for financial services organizations, businesses must ensure a foundation in first-party data.

Financial services brands have traditionally been very transactional (pun intended), focusing more on cutting costs rather than deepening customer relationships. But they’re discovering that modern consumers demand more.

Whether engaging with banks, credit card companies, insurance providers or wealth management firms, today’s consumers expect the same level of convenience and personalization they’d receive during a retail experience. In fact, one study found that 72% of consumers view personalization as “highly important” when it comes to financial services.

And the competition is listening. Look no further than the new, technology-focused disruptors that seem to enter the financial services space every day. More than 80% of financial institutions believe their business is at risk due to these emerging innovators.

Many financial services organizations know they must evolve to keep up with customer expectations, but they’re trying to do so at a difficult time. The changing regulations surrounding third-party cookies means marketers can no longer rely on anonymous third-party data to engage, measure and personalize communications and offers.

But all is not lost. By building a strong first-party data foundation today, financial services companies can build a future-proof solution. Here are three ways financial services brands can stay ahead.

Cookie Deprecation: 3 Ways Financial Services Brands Can Thrive

1. Get to Know Unknown Customers

Customer centricity is key to providing superior customer experiences. That’s why industry disruptors prioritize products and services that are tailored to consumers’ wants and needs, providing convenience and accessibility customers may find lacking from traditional financial institutions.

But with the disappearance of third-party cookies, how are financial services brands supposed to ensure experiences are built around the customer? The answer lies with the customers they already have.

Financial services companies generally have direct access to their end customers, as well as significant amounts of authenticated traffic across different digital channels. By analyzing this data, organizations can spotlight and segment their most high-value customers.

After identifying common attributes and actions and using them to optimize customer journeys for acquisition and conversion, it’s a simple matter of employing lookalike models to engage unknown audiences who share the same behaviors and preferences.

By orchestrating customer journeys for unknown prospects who are similar to their most valuable customers — and encouraging them to authenticate themselves early in the journey — financial services brands can offset cookie deprecation and ensure they’re investing resources in the areas most likely to drive the best business outcomes.

2. Break Down Data Silos

While financial services brands may have large amounts of customer data available to them, there’s no guarantee it’s accurate or accessible.

Different departments may have different technology stacks, and with no tool to centralize and standardize this information, data remains disjointed, unhygienic and rife with duplicate customer profiles — all of which result in poor customer experiences.

Imagine a bank customer with a personal account who is also starting a small business. Now imagine that customer being bombarded with the same information about products and services for small businesses multiple times from different teams. Or receiving irrelevant offers that have nothing to do with their business plans. Or not being targeted and engaged at all.

Now imagine that same customer, but they receive tailored messaging on their preferred channels and at the times most likely to drive engagement. Communications are highly relevant, cognizant of where they are in their journey and demonstrate a holistic view of their financial life.

The latter scenario is clearly preferable (and much more likely to result in customer stickiness), but if customer data is fragmented and business teams lack visibility, it’s not possible.

First-party customer data is a goldmine in a world of third-party cookie deprecation, but only if organizations can trust and analyze it. Invest in a solution that will enable you to unify your customer data and empower internal teams to access a comprehensive customer view — all while providing the necessary regulatory compliance safeguards.

By ensuring business users can understand customers at scale and quickly uncover valuable insights without having to rely on IT teams to gather and make data available, financial services brands will improve customer experiences while eliminating frustrating (and costly) bottlenecks.

Hear M&T Bank explain why customer data platforms (CDP) are critical to financial services organizations:

3. Prioritize Experience Orchestration

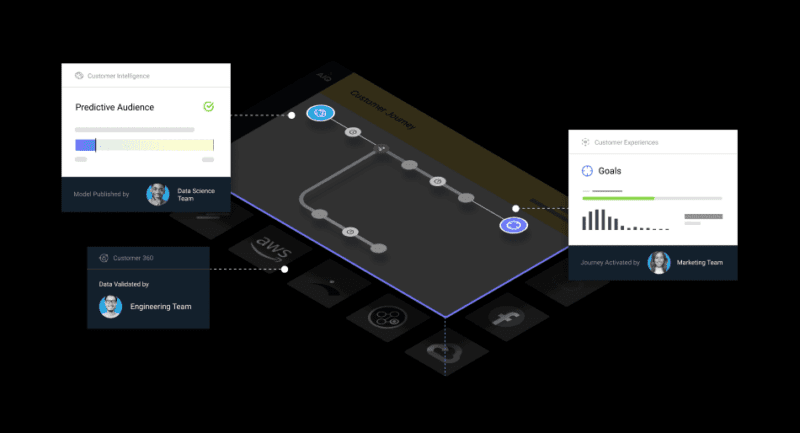

Even if customer data is clean and connected, it’s not much use if it can’t be operationalized into customer experiences. To extract value from customer data, financial services brands must ensure business teams can activate it as well as access it.

For instance, say an audience cohort uses a mortgage calculator on your website but doesn’t call an advisor to follow up on it. Financial services brands can develop a multi-step customer journey specifically for this audience that features helpful, relevant tips related to buying a home and encourages prospects to get in touch.

Unfortunately, legacy technologies often hold organizations back. Outdated campaign management tools can’t handle the complexity of today’s customer journeys, saddling financial services brands with slower time to market, lack of marketing access to data and audiencing and limited cross-channel capabilities.

And while master data management systems are essential to resolving customer identities, they don’t excel at managing anonymous customer records or deduplicating them, to say nothing of segmenting, analyzing and activating customer data across channels.

By adopting the right technology now — one designed to help everyday business users deliver exceptional CX — financial services brands will thrive in the cookieless future.

How to Overcome 3rd-Party Cookie Deprecation

Download The Financial Services Advertiser’s Guide to CX in a Cookieless World to understand how third-party cookie deprecation may impact your business use cases and what you can do to set yourself up for success.