What You Need to Know About the Salesforce CDP

With the rise in machine learning and advancements in marketing technology, it’s no surprise that more and more companies want to enter the CDP market. During Dreamforce 2019 Salesforce announced “Customer 360 Audiences” its customer data platform. It’s now Fall 2020, and they are finally ready to step out of beta testing and release.

With Customer 360 Audiences almost on the scene, all three marketing clouds are now claiming they have their own CDP offerings. Oracle released CX Unity in September 2019, and Adobe’s CDP rollout in November.

So how will it fare against expectations?

Here’s a recap of what Salesforce promised along with ActionIQ’s take on the probable realities.

What Salesforce Promised: Customer Data Platform Vision

“It’s the beating heart for Salesforce for Marketing” keynote by Adam Blitzer SFMC CEO

The (Likely) Reality

Salesforce will likely evolve their vision in the future, but for now, a vision that depicts the CDP as a heart forgets to prioritize one key capability— intelligence. Hearts are muscles that do not include intelligence as an output, and personalized marketing requires intelligence in the form of customer insights and predictive recommendations. It is to believe that Salesforce’s own data sources are to be ingested into Customer 360 Audiences automatically, from their Marketing Cloud and service data from Service Cloud, etc. For those organizations who don’t leverage the CRM (customer relationship management tool), Salesforce is building integration mechanisms to pull in data from ERP systems, POS systems, offline sources, and various other endpoints (learn the difference between CDP versus CRM here).

Premier CDPs go beyond the role of a heart and act as the central intelligence brain of the martech stack (collecting, deduping, analyzing, predicting, and orchestrating customer data). They help consumers achieve their goals through intelligently personalizing experiences.

Perhaps this is why Salesforce has focused their energy first on 360 Data Manager, which behaves similarly to a lightweight MDM, or should I say a heart that receives and distributes snippets of data across the organization for operational use cases in sales and service. Maybe later, they’ll evolve the product to a brain.

Impact on Organizations

CDPs and CDP marketing is on the rise, but still relatively new. Be prepared to wait patiently as the Salesforce CDP is released in iterative phases over the next few years.

What Salesforce Promised: Product Use Cases

- 360-Degree View of Customer w/ Consent Mgmt

- Advertising Suppression

- Real-Time, Omnichannel Personalization

- Customer Insights

The (Likely) Reality

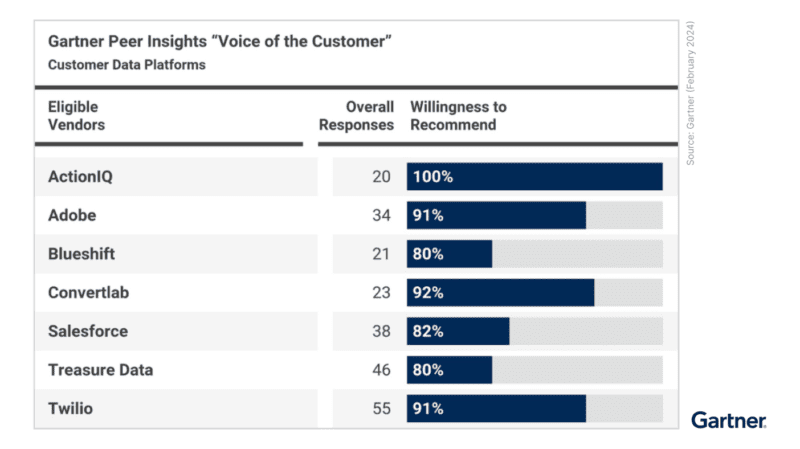

These are table stakes use cases for a premier-grade CDP, and it will likely be years before the Salesforce infrastructure is scaled out to support all of them (industry analysts say it could take years before marketing cloud CDPs catch up to start-up CDPs). For what it’s worth, Salesforce has a rich history of buying software (e.g. ExactTarget, Demandware, Datorama, Tableau), and it’s not out of the realm of possibility that Salesforce switches to that strategy to prevent the market from slipping out of their hands.

Impact on Organizations

Until Salesforce has a product that fulfills all of these use cases in a single solution, organizations will likely do one of two things: 1) buy an already-completed CDP, or 2) utilize a piecemeal structure between Salesforce’s early “CDP” and point solutions that fulfill the rest of the use cases (trade-offs are non-native integrations and extra hand-offs between users).

What Salesforce Promised: How It Will Work

“You can think about the Customer 360 federation capability [SF 360 Data Manager] as a firehose into a data lake […]. With all this data centralized we can pull out audiences of customers based on interactions that are happening anywhere within the Salesforce Customer 360 Platform. This is Customer 360 Audiences.” interview by Patrick Stokes – EVP of Platform Shared Services

The (Likely) Reality

It appears like Salesforce is going to make organizations utilize 360 Data Manager as the collector and deduplicator of customer information. This isn’t necessarily good or bad (as the product just went GA and hasn’t been vetted in large scale yet), but what’s troubling is that 360 Data Manager requires Salesforce’s Customer Information Model (CIM) to operate (forcing to use the Salesforce Platform). CIM requires organizations to conform their data to a specific format in order for 360 Data Manager to process it.

Impact on Organizations

While standardized data formats seem like a fair idea at first glance, the tradeoff with CIM is flexibility— what works for one organization usually doesn’t work perfectly for another. It looks like Salesforce’s CDP requires such strict data guidelines. Conversely, premier CDPs run atop an architecture that supports full flexibility of data models for each organization, enabling greater agility and accuracy of marketing throughout the entire customer journey (contact me to learn all the underlying nuances).

What Salesforce Promised: Successes To Date

‘Our CDP is in pilot’

The (Likely) Reality

At Dreamforce, I only heard one organization mentioned as participating in the pilot, Shutterfly (for reference Adobe mentioned 5 organizations in their CDP pilot announcement). The choice of Shutterfly is conveniently low-risk for Salesforce, given Shutterfly is not currently listed on Salesforce’s appexchange (for direct mail execution) and may view this pilot as a win-win outcome for both brands. If true, this means it would be unlikely that Shutterfly would paint anything but a rosy picture of the pilot.

Impact on Organizations

With only one organization using their CDP in pilot, it’s unlikely Salesforce will be ready to deliver a full-scale CDP in 1H2020. Marketers should assess their PR carefully.

What Salesforce Promised: Product Readiness

Our CDP is “Expected to be generally available in 1H2020”

The (Likely) Reality

Building this type of solution takes incredible time and energy. Adobe CDP took much longer than 7 months before promoting their beta to GA (which they likely only did because of a history of upstaging Salesforce’s technology announcements before Dreamforce and Connections, a favor that Salesforce returns each year before Summit— hilarious).

When Salesforce announces their CDP as generally available, it’s unlikely to meet all four core capabilities of a CDP inside a single solution (single-customer-view, analytics, orchestration, self-service). Remember the bail-out word in their statement— “expected”.

Impact on Organizations

Do not be surprised if Salesforce cannot catch up to fast-moving start-ups who have already finished their CDPs and are moving onward to market-differentiating features.

In closing, marketers should approach the Salesforce CDP with a careful eye, making sure it can deliver on the prioritized needs of your organization. A good customer data platform should be able to provide improved customer engagement and audience segmentation via data integration (of multiple channels) and personalized experiences throughout the customer journey. It’s why I suggested you follow these five steps when deciding to evaluate a CDP into your martech. A mid-selection will set your organization back a full year toward delivering personalization at scale.

If you’re already on the path of evaluating CDPs, consider these next steps:

- Contact ActionIQ to learn more about the benefits being realized by organizations in your industry (e.g. retail, banking, media, subscription, telco, travel, etc.)

- Talk to one of our experts to reveal the most critical features of a CDP, the ones that end up predicting users’ satisfaction and success with the technology.

Already at the stage of an RFP? Learn the best practices of RFPs, including identifying the use cases specific to your industry. We also can send you an RFP template to ease your burden during the evaluation.