What Is Customer Lifetime Value?

Customer lifetime value (CLV) is the total revenue a single customer spends with your business over the entire span of their relationship with your brand. It’s one of the single most important metrics you can track. And for customer experience (CX) professionals and marketers, it’s an absolutely fundamental “North Star” key performance indicator (KPI).

Succinctly put, customer lifetime value helps you identify how much an existing customer is worth to your brand, from a topline perspective. It guides decisions such as:

- Which customers should I invest in acquiring and how much can I spend to do so?

- Which customers should I invest in retaining and how much should I spend to do so?

- Are my offerings and customer experiences succeeding in driving customer loyalty?

- What is the health of my overall marketing, CX, sales, product, and brand strategy & execution?

Why Does Customer Lifetime Value Matter More Than Ever?

To explain why customer lifetime value is more important than ever, it first makes sense to talk a little bit about customer acquisition and customer acquisition costs (CAC).

20 years ago, customer acquisition via digital marketing was a young industry. Marketing efforts were trying to determine on how to make it effective—but remained largely focused on traditional mass media and direct marketing techniques to deliver results.

By about 10 years ago, advances in technology and best practices (in the form of ad tech, display advertising, programmatic marketing, and more) caused digital acquisition marketing to take off. Savvy marketers could cost-effectively acquire customers using targeting and analytics techniques never before seen. It was an exciting time with lots of opportunities, and the most forward-thinking brands seized on it to acquire a whole new crop of customers at a relatively low cost. Customer acquisition was everything.

Today, digital marketing is the premier mode of acquisition for consumer-facing businesses as well as many B2B businesses, especially those who classify themselves as B2B2C and B2SMB. Digital advertising has converged on a handful of major platforms holding near-monopolies (or perhaps real monopolies). Most notable among these are Facebook and Google. At the same time, competition for new eyeballs and new prospective customers on these platforms is intense.

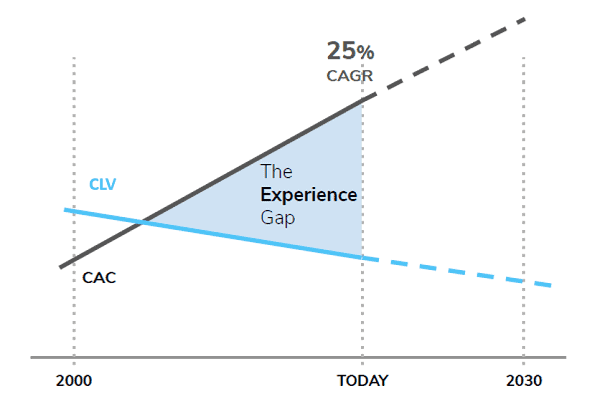

As a result, acquisition costs have been rising at a staggering rate of 25% per year. Today, customer acquisition is extremely expensive.

Compounding the challenge is a steady decline in the quality of acquired customers, which has also been occurring over the last 20 years—driving customer lifetime value lower. With CAC exceeding LTV, the industry is now experiencing an unsustainable experience gap—where the quality of customer experience is insufficient to cement enough customer loyalty to overcome acquisition cost.

Increasing customer acquisition costs along with flat or declining customer lifetime value has given rise to an “experience gap.” Leading brands are using customer-centric strategies to close that gap and increase customer lifetime value.

With the costs of digital marketing out of control, hemming in CAC is difficult. It now costs 5 times more to attract new customers than it does to nurture existing ones. Yet a 5% increase in customer retention can boost profits by 25% to 95%.

So the pendulum has swung to focusing on long-term customer lifetime value. Retaining customers and making them more valuable is now the fastest and most efficient path to growing revenue—driving the initiation of customer-centric transformations across leading brands in nearly every industry. And making measuring, predicting, and growing customer lifetime value more important than ever before.

How To Calculate Customer Lifetime Value

There are a number of approaches to calculating customer lifetime value. Each has its merits based on the way your business operates and the data you have available. The intent of this piece isn’t to go deep into calculation approaches, but rather to work at the conceptual level. So let’s take one of the simplest expressions of customer lifetime value:

Customer lifetime value = average order value (AOV) * # of purchases each year * # years in the customer relationship

Say you sell auto insurance. If the average annual policy costs $1,427, the average customer renews once per year and stays with your brand for an average of 6 years, then your customer lifetime value is $8,562.

You can further segment your CLV calculation to handle how it changes across different types of policies and customers. For instance, you may find that CLV is higher for luxury vehicle owners, high-risk drivers, or policies that use an agreed value method for paying out losses.

If you’re good at segmentation (demographic, transactional or behavioral segmentation), calculating customer lifetime value in this way can tell you how you’re performing overall and in each of your segments, right now. And by linking that performance to the past marketing programs, experiences, and interactions by customer segment, you can understand how your prior strategies, decisions, and actions have impacted customer lifetime value. This is great for knowing where you stand across all your high value customer segments, and why. This type of CLV analysis is sometimes called descriptive (what happened?) and diagnostic (why did it happen?).

While descriptive and diagnostic analysis of CLV is foundationally important, it doesn’t do a lot to help you figure out how to improve your customer lifetime value. For instance, the CLV formula we used above becomes problematic when you take the analysis down to the individual customer. That’s because the customer you’re looking at is still in the middle of their relationship with you—so you’re missing data for the “# of years in the customer relationship part of the formula.”

That’s why the real key to mastering customer lifetime value is based on forward-looking analysis. You need predictive and prescriptive analytics, down to the most granular customer level, all of which then drives customer experience actions taken by your business.

Predicting Customer Lifetime Value

How do you go from understanding “who was my best customer?” to “who will be my best customer?” One technique, known as lookalike modeling, can be especially powerful. In lookalike modeling, you use analytics to identify specific traits and behaviors of your existing and past “most valuable” customers. This can be done through traditional analytics, or with augmentation from AI and machine learning. Then, you use further analytics and AI to identify those traits—and early signals of similar behaviors—in prospective and existing customers, scoring them for the likelihood to become a customer with high customer lifetime value.

These insights are the key to efficiently spending acquisition and customer retention dollars, driving down CAC, increasing CLV, and giving your business a tremendous competitive edge.

Here’s one example: as a result of a series of analytics conducted by ActionIQ and our clients, we discovered that customers who make purchases in more than one channel tend to be significantly more valuable than those who purchase in one channel only. In fact, multichannel customers deliver:

- 2x average annual revenue than other types of loyal customers

- 130% higher annual gross margin than other types of loyal customers

- 50% more brand loyalty, with greater purchase frequency year after year

With this knowledge in hand, our clients then asked “what if I could drive just a 1% increase in my cross channel shopping segment?” The answer: millions in annual incremental revenue. Many of our unique customers went on to build analytics that identify likely cross-channel shoppers and then launched personalized, targeted campaigns and journeys to convert the behavior.

Increasing Customer Lifetime Value

In the previous example, we described how you can increase overall customer lifetime value by targeting, acquiring, and nurturing a high value customer base that is likely to become your most loyal customers.

But what are some of the other ways you can raise loyal customer lifetime value? Here are a few that comprise part of an overall customer-centric marketing strategy:

- Increase customer satisfaction. There’s a direct correlation between customer satisfaction and revenue. Focusing on NPS scores, for instance, will boost CLV.

- Personalization. Communications and offers that take into account your customer’s past relationship and current needs are instrumental to cementing a loyal customer.

- Repeat purchase and cross-sell campaigns. Customers who have a positive experience with your brand will appreciate and be more responsive to offers.

- Brand loyalty programs. Loyalty programs offer insights into offline purchase behavior and allow you to reward and more personally communicate to better retain customers.

- Retention campaigns. Spotting churn signals early and targeting customers with personalized retention campaigns can reduce churn rate and be a big boost to CLV.

Modern Tech for Increasing Lifetime Customer Value

The brands who are most successful at increasing lifetime customer value don’t look at any of the above initiatives as individual campaigns, however. They are part of a much larger marketing strategy to put the customer at the center of everything they do. Achieving this means making an organization-wide commitment to transform your people, process, and technology.

At Action IQ, we deliver that technology. And we help with the people and process part, too. ActionIQ’s leading customer data platform (CDP) is designed to help you increase your entire company’s focus on the customer. With a CDP like ActionIQ’s you can::

- Empower all your teams with the analytics and tools they need to understand customer lifetime value, and the strategies they can use to improve it

- Orchestrate authentic existing customer experiences, across all channels tailored to your (potential) best customers’ traits

- Bring together all your customer data, providing your CX professionals (including marketing, service, and sales) with governed access to everything you know about your customer

Start Boosting Customer Lifetime Value Today

ActionIQ’s technology and experienced team can help deliver in your strategy to grow customer lifetime value to achieve a lasting competitive advantage. For a complimentary consultation with one of our top experts, please contact ActionIQ today.