If You Can’t Beat Them, Join Them: Adobe & Salesforce Join the CDP Club

3 Questions Every Brand Should Before They Consider Leveraging a Marketing Cloud as their CDP

The Customer Data Platform market continues to evolve with CDP Marketing Cloud claims from both Adobe and Salesforce finally officially entering the scene this fall. For those of us who have been building this category for the last several years – we want to say welcome to the club! This is a huge acknowledgment from the two biggest players in the marketing technology space, so we wanted to provide some context and clarity around the announcements and how we view this shift.

Marketing clouds are essentially a collection of point solutions—e.g. CRM, content management, email service provider, DMP, workflow management, etc.—brought together to form a martech ecosystem (often via acquisitions). Their capabilities are circle around campaign management considered ‘final-mile’ since they deliver the final campaigns and messages to the end consumer (and they’re adept at doing so). (Learn the difference between a CDP vs. DMP here)

CDPs are the single source of truth. CDPs are engineered to be the brain of the martech stack that creates the organization’s single customer view and generates operational efficiency by enabling data democracy for business users. CDPs ingest and organize data from all kinds of disparate data systems and are vendor-agnostic by design, thereby enabling a best-of-breed technology strategy.

Where CDP marketing clouds fall short is in lacking a common infrastructure to unify data across all channels, resolve duplicate identities, identity resolution, and serve as the one-stop-shop for marketers to analyze customers and orchestrate experiences across all marketing, product, support, CX, and commerce channels.

Finally, while marketing clouds often enable personalization within a channel, CDPs collect data and automate personalization across all channels for seamless CX.

What Do These Announcements Mean?

Adobe and Salesforce’s expertise is not in customer data. Their pedigree is in content (think Adobe products like Photoshop) and business applications (think Sales Cloud). Both “built” their marketing product portfolio (Cloud) through a multitude of channel-focused acquisitions (think Campaign and ExactTarget – both ESPs). Fundamentally, these are execution-first products with very limited data capabilities and therefore their tool limits the amount of insights into the customer journey.

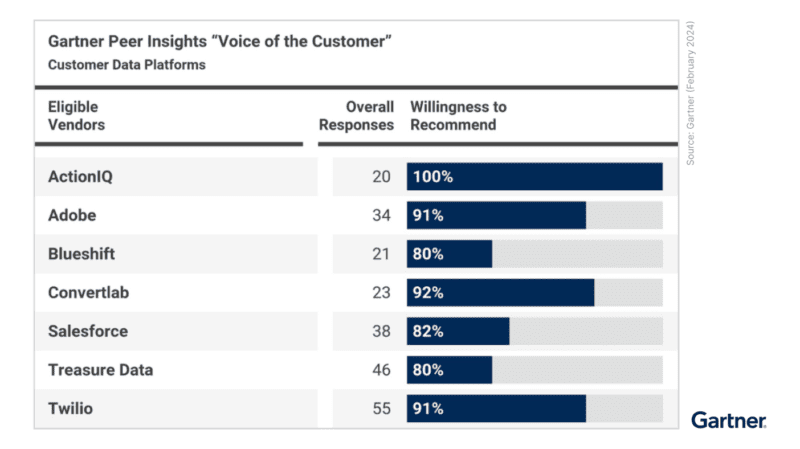

These announcements mark Adobe and Salesforce’s attempts to pivot down from the execution and content layer into customer data. This is BIG. Not just for the marketing clouds, but also for the Customer Data Platform market. For the last two years, we at ActionIQ have been evangelizing the value of CDPs for enterprise marketers. In the last week, we’ve had two very large voices join the club and validate the market need – welcome, Adobe & Salesforce!

Why Are Adobe & Salesforce Pivoting To Customer Data?

Let’s just say it’s been a journey. Their first response was to say “we already do that!”, due to the popularity of their notorious CRM system. But as the CDP market picked up momentum, they were forced to respond. Salesforce called CDPs a “passing fad” and Adobe announced a new data layer they described as “more than CDP”. Fast forward to just a year later, Salesforce is finally committing to a check-the-box CDP platform, and Adobe announces an (another?) CDP. What changed?

Ultimately, the market and their own clients forced them to make this change. We know for a fact that in the last 6-12 months both Adobe and Salesforce have lost out to smaller startups with CDP capabilities that power personalization at scale and customer segmentation.

We also know that once the honeymoon wears off from an Adobe or Salesforce marketing cloud CDP purchase (think 12-18 months) enterprises start to realize that data integration and unification is not their core competency, nor the reality of their offering. Both the market and clients have succeeded in pressuring the marketing clouds to acknowledge their existing data gap and promise a future solution.

How Should Brands Think About This?

Now for the most important question, how should brands evaluate these announcements against their marketing strategy and capabilities? This can be summarized in 3 simple questions all brands should ask themselves:

1. Do you believe Adobe and Salesforce can build a CDP?

Unifying every customer touchpoint into a unified profile and then leveraging that data into personalized experiences is not an easy task. This goes back to an organization’s core competencies – do they have the pedigree and proof points to make you believe they can pull this off?

Building a CDP requires deep expertise in data integration and architecture which becomes the foundation of the entire platform. Data must be a core competency and this can’t be solved through yet another acquisition.

Adobe CDP and Salesforce CDP may have some catching up to do despite being titans of industry. You want to ensure the CDP offering you select is a true CDP and not just claiming to be a CDP. This means machine learning that can leverage multiple channels for segmentation and to create a unified customer profile to create personalized customer experiences throughout the entire journey.

Moreover, your insights from a customer data platform and real-time customer data and profile generation are only as good as the accuracy of your data and be sure the analytics you use are being leveraged correctly.

2. If you believe they can build a CDP, can you afford to wait?

This won’t be a quick fix. Salesforce’s and Adobe’s CDPs will inevitably have to catch up to the offerings and experience of the general CDP market. At ActionIQ, we spent the first two years of our existence building out this data layer (and we didn’t have to deal with decades of legacy technology). Building foundational data infrastructure for a real-time CDP takes time in order to be truly effective for B2B, service and product marketing.

Big companies have a major force working against them that hyper-focused startups don’t: momentum. And not the good momentum, but the kind that makes doing anything new extremely difficult. Change is hard, and when it comes to something as foundational as core data infrastructure, it takes a long time.

3. If you can afford to wait, does it make sense for you to go all-in on a single cloud?

To answer this question, you have to ask another question – do you expect Adobe or Salesforce to be the only CDP vendor you ever use, i.e., is it reasonable for your business to live completely within their walled garden?

Even if you believe Adobe or Salesforce can build their own CDP in a reasonable amount of time, you would still be constrained to only the channels that live within their cloud. Vendor lock-in is a major risk a company must consider, and in this case, it’s lock-in of your entire marketing tech stack.

At ActionIQ, we believe that brands should have the flexibility to choose best-in-class channel solutions for themselves and reduce switching costs when their strategy changes or the vendor falls behind. We work with your company and data governance requirements to ensure that you get the most insights as possible from your CRM.

In closing, Adobe and Salesforce CDP‘s are good for the market as a whole. We see the last week as a massive win for the Customer Data Platform market and, more importantly, for brands wanting to be more personalized and customer-centric.

CDPs will be a foundational layer in the enterprise marketing stack going forward – powering personalization at scale while optimizing marketing performance and efficiency. Every marketing team will keep a close eye on Adobe and Salesforce to see the progress make in the CDP space.

With these announcements, everyone has now acknowledged that a single view of the customer is an unsolved problem and we can all move on to evaluating who has the best solution to solve it not just in the future, but right now.

Additional Interesting Reads:

Adobe Experience Cloud vs ActionIQ

CDP Market Guide (updated yearly)