Hot Take: Salesforce’s Evergage Acquisition

Salesforce Customer 360 acquired Real-time personalization solution Evergage

Another week, another acquisition in the CDP space—does this sound familiar? Evergage, a real-time web personalization engine, announced it was acquired by Salesforce, which intends to add the acquired tech to its marketing cloud application suite. Let’s put this into perspective: a company building a CDP just bought a company claiming to be a CDP to not use it as a CDP…everything clear? This acquisition continues the trend of consolidation within the customer data platform category, but it also sheds more light on the strategies CDP vendors and Salesforce are pursuing in 2020.Evergage brands itself as a real-time personalization and CDP provider.

Our real-time, cross-channel personalization and machine learning capabilities complement Salesforce Marketing Cloud’s robust customer data, audience segmentation and engagement platform, enabling companies to deliver more relevant experiences during moments of interaction across the entire customer journey,” Evergage CEO and co-founder Karl Wirth wrote in a blog post

What does this tell us about Evergage

Evergage is one of the vendors to blame for market confusion in the CDP space. From 2010 until 2019, they classified themselves as a personalization engine. Then, in early 2019 they added “CDP” to their branding. So what does Evergage actually do? Essentially, they tag your site and use the digital exhaust to create personalized offers and web experiences based on click behavior.

Despite the company’s effort to jump on the CDP bandwagon by ingesting non-Evergage data via a data warehouse product offering, their strength remains solely in web personalization. It’s yet another example of a channel-specific solution (in this case web) trying to bolt on an off-the-shelf database and call itself a CDP. Unfortunately, this is how the majority of vendors claiming to be a CDP have entered the space. This acquisition should serve as notice to anyone currently evaluating CDP offerings—be certain to scrutinize your candidate vendors for recent pivots in product positioning.

If you purchased Evergage to be your CDP, unfortunately you are now back at square one after this acquisition. Similar risks exist for companies who are considering tag/SDK vendors as their CDP solution. Tag/SDK systems fall short on CDP requirements as they, like Evergage, have taken the “bolt on” approach to repositioning as a CDP. Additionally, because tag/SDK companies’ primary offerings have become commoditized, they are ripe for near-term acquisition by Salesforce or one of the other marketing clouds. If you are evaluating CDP vendors, we recommend you confirm they are actually a CDP by 1) examining the pedigree of the vendors’ team and technology and 2) digging into the real-world client problems the vendor is successfully solving in the field.

What does this tell us about Salesforce

This acquisition is not a surprising move on the part of Salesforce. They have a real product gap around website personalization, which is what Evergage does well. It’s also another data point confirming Salesforce is much more comfortable buying technology (see Datorama, Mulesoft, Tableau) than building it themselves.

As of yet, Salesforce has not made an announcement about the acquisition. This likely means they’ll quietly rebrand Evergage as Personalization Studio within the Salesforce marketing cloud. Adding to the list of acquisitions that sit within the marketing cloud that are not integrated and lack a true data layer.

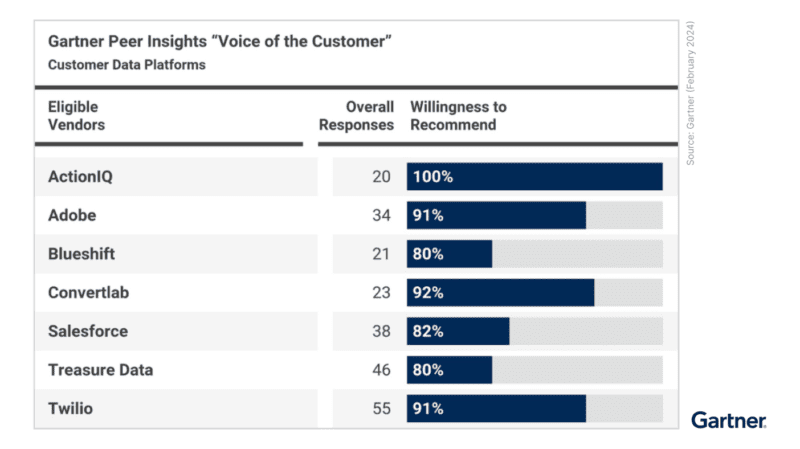

This brings us to the heart of Salesforce’s marketing cloud strategy—continue to build out their walled garden through channel-centric point solutions, while obfuscating on what their CDP will look like and when it will be ready. The real losers here are Salesforce marketing cloud clients. This acquisition does not get Salesforce any closer to closing their glaring data gap. And it eliminates the option for a brand to choose their preferred channel vendor—it’s an all-Salesforce-or-nothing value proposition.

Ready to discuss a best-in-breed solution approach? Contact us today to talk to an ActionIQ Expert.