What is the Salesforce Marketing Cloud CDP?

The customer data platform (CDP) market is confusing — but it doesn’t have to be. “What is the Salesforce Marketing Cloud CDP?” is part 2 in a series of blog posts exploring different types of CDP vendors, how their products differ from other technologies and what you can do to select the right CDP for your enterprise company. Check out part 1 on the Adobe Marketing Cloud CDP.

Because of the popularity of its customer relationship management software, Salesforce has widespread brand awareness. Yet confusion remains about what Salesforce considers its CDP.

Founded in 1999, Salesforce is a cloud-based software company that provides customer relationship management (CRM) solutions and a wide range of other enterprise software solutions, including marketing automation, e-commerce, analytics and artificial intelligence.

Despite former Salesforce Marketing Cloud CEO Bob Stutz referring to CDPs as a “passing fad,” the company announced the pending development of a formal CDP in 2019 as part of the Salesforce Marketing Cloud.

Since then, Salesforce has added several capabilities to its Marketing Cloud through acquiring vendors such as Datorama and Evergage, which bolstered its CDP offering to what it is today. Salesforce has announced new names and positioning for their CDP every year since the initial launch — from Customer 360 Audiences, to Salesforce Interactive Studio, to Salesforce CDP and now, Salesforce Data Cloud — however, it is still considered functionally thin.

Who is the Salesforce Marketing Cloud CDP for?

Salesforce claims its CDP is intended for business users, but the current offering of the product is more geared towards supporting technical users who are tasked with unifying data across technologies to create a customer 360 for their business teams.

The Salesforce CDP has high licensing and support costs, as well as a lack of integrations with technologies outside the Salesforce Marketing Cloud. As such, it is tailored to enterprise organizations that are already significantly invested in Salesforce Marketing Cloud point solutions.

How Do You Use the Salesforce CDP?

As analysts have pointed out, neither Salesforce product is designed for the full array of CDP use cases. The fastest way to understand how they should be used is by inspecting each tool’s underlying architecture.

Salesforce CDP, now rebranded as Salesforce Data Cloud, is the data management and audience segmentation layer within Salesforce Marketing Cloud — their all-in-one solution. To support CDP use-cases throughout the customer lifecycle, multiple Salesforce tools are required in addition to just the Salesforce CDP. This results in high license and service costs, and increases time to value. Most of these tools were acquired by Salesforce, so they do not work together as seamlessly as expected.

Now that Salesforce has officially retired its data management platform (DMP), the company may invest more seriously in its CDP(s). However, like the Adobe CDP, the Salesforce CDP will require you to use other Salesforce products and discourage integration with non-Salesforce tools and data sources.

What Are the Pros & Cons of the Salesforce Marketing Cloud CDP?

The Pros:

Named the #1 CRM provider for several years in a row, Salesforce has a strong track record as a leading provider of cloud-based enterprise software solutions. Salesforce offers several other tools and has acquired adjacent technologies to complement its CDP offering as well as marketing functionality as a whole, giving it an all-in-one approach that may be attractive to some organizations

They also have a strong dashboard and reporting functionality. Users can license Salesforce’s intelligence offering — namely Datorama and Tableau — for campaign reporting and analytics. Salesforce Einstein adds machine learning and artificial intelligence capabilities for predictive analytics, which is built into all Salesforce applications including Salesforce CDP.

The Cons:

There’s very limited information about the Salesforce CDP’s success in the real world, making it difficult to highlight benefits. However, analysts refer to the Salesforce CDP as “very much under construction,” as well as, for a larger enterprise, “ungodly expensive.”

Like Adobe, Salesforce requires you to license different tools within its marketing cloud to execute on common use cases supported by well-established CDPs. For example, organizations must license Salesforce Engagement (formerly known as Salesforce Journey Builder) for customer journey design and orchestration (but beware of its lack of full omnichannel capabilities). Because channel engagement tools are used for segmentation and campaign management, segmentation is done in separate tools based on fragmented data.

Since Salesforce only architected a few of its tools to operate together, it means you’ll likely pay services costs in the six or seven figures to integrate them — and this is in addition to the enormous licensing costs typical of large marketing clouds.

You can also expect deployments to take up to a year for anything beyond basic use cases, as all data must be preformatted in order to fit into either of Salesforce’s CDP offerings.

Without a doubt, one of the biggest risks associated with the Salesforce CDP concerns vendor lock-in.

Because marketing cloud architectures make it difficult to replace older solutions with newer, more cutting-edge technologies, organizations must use only one brand’s solutions. For context, 56% of marketing technology buyers prefer taking the best-in-breed approach. In 2022, Salesforce launched an integration with Snowflake through data sharing, described as zero-copy architecture. However, since data is still forced to be copied into the Salesforce ecosystem, it’s not a truly composable solution.

This Salesforce limitation is especially concerning when you consider that the majority of marketers add new types of technologies to their martech stacks on a monthly or quarterly basis.

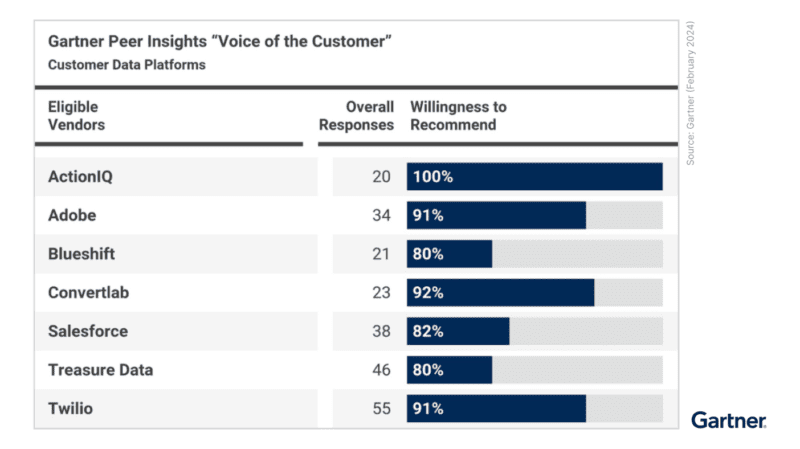

How Does ActionIQ Compare to the Salesforce CDP?

Unlike the Salesforce CDP, ActionIQ takes a flexible approach to martech management. We empower enterprise organizations to integrate new technologies with their CDP so they can drive innovation and personalize customer experiences across every marketing channel.

Not only does ActionIQ’s composable CDP have robust integrations with different martech systems, ActionIQ also integrates seamlessly with Salesforce tools, increasing the value of a client’s Salesforce stack.

Our proprietary HybridCompute data infrastructure provides unlimited and flexible computation power, where you want it — directly in your data lakehouse or warehouse, in ActionIQ or both. Additionally, our intuitive UI helps non-technical business users quickly access the customer data they need and activate it across whichever final-mile experience delivery solutions they prefer.

For acquisition marketing, ActionIQ offers a flexible identity framework, so organizations can manage identities across anonymous and known customers from first, second and third-party sources. Salesforce is missing integration with third-party identity vendors (with a recent partnership announcement with Liveramp) and lacks the capability to make anonymous visitors addressable.

Thanks to the easy-to-use tools ActionIQ provides, business users can efficiently analyze audience insights, segments and behaviors while orchestrating multi-step customer journeys. And you get to do this without having to simultaneously rely on technical resources.

The result? We help you reduce data analyst workload by 40% while driving a return on investment of 522%.

Psst … in part 3 of this blog series, we explore the Segment CDP.

Learn More

Download our CDP Market Guide to learn more about different types of CDPs. You can also contact one of our experts to see how ActionIQ differs from Salesforce and other marketing cloud CDP options.