4 Winning CDP Strategies for the Insurance Sector

Consumer expectations for seamless and intuitive experiences across brand touchpoints continue to rise across all industries, but this trend is especially relevant for insurance carriers.

Similar to how Amazon, Uber, Netflix and others have raised the bar for traditional products and services with greater convenience and personalization, the insurance industry is experiencing an influx of disruptors who offer a subset of services in a more accessible format.

In our recent webinar — How CDPs Power Intelligent Marketing Communications — we spoke to innovative insurance provider OnStar Insurance and leading marketing services agency Goose Digital about the importance of a customer-centric strategy and best practices for deploying a customer data platform (CDP) to achieve it. Here are the top four takeaways from that discussion.

1. Put Customers at the Center of Your Business Strategy

According to a recent survey from J.D. Power, auto insurance websites are now more important than agents in terms of customer interactions and service. In fact, 34% of insurers’ total interaction scores are attributed to experiences on digital channels.

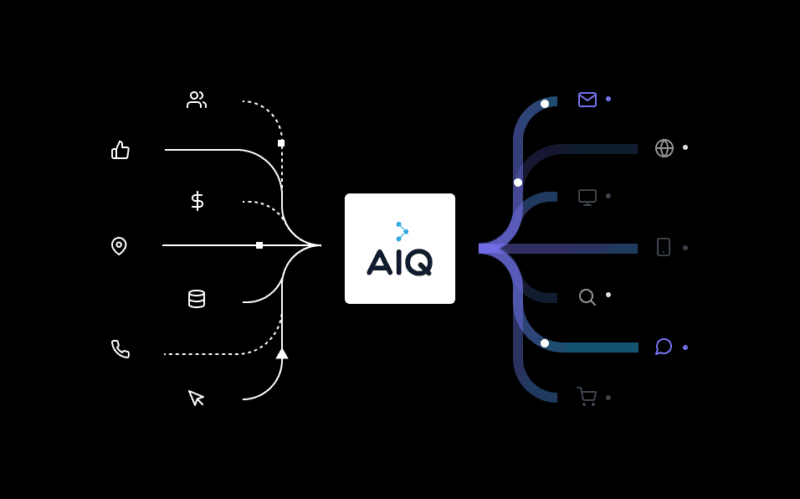

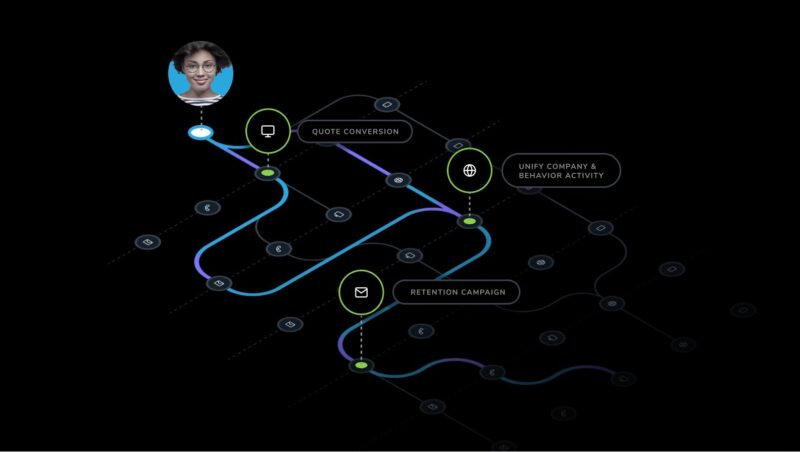

Customers expect to engage with insurers when, where and how they want — and receive a consistent, personalized experience. Customer data is essential to achieving this, but there’s a gap between gathering data and transforming it into customer experiences. CDPs bridge that divide.

“The customer experience mandate isn’t going away because consumer expectations are just going to continue to evolve,” said George Phipps, Director of Product Marketing at ActionIQ.

By creating unified customer profiles from their disparate data sources — and democratizing those insights for marketers, salespeople, customer service representatives and others to use — insurance providers can put their customers at the center of their strategies and deliver superior CX.

2. Instill Trust by Prioritizing Privacy

CDPs don’t just help brands make their customer data actionable, it also helps them meet privacy and security standards — a particularly important factor for the highly regulated insurance sector.

“We’re looking to be personalized insurance,” said Deidre Watts, Head of Customer Acquisition & Insights at OnStar Insurance. “The world that we live in today with customer expectations and privacy, GDPR and so forth, it’s critical to have flawless execution to the customer.”

CDPs enable insurers to maintain compliance with ever-changing security and privacy measures by enhancing control and governance of where data is stored and how it’s used.

Additionally, increasingly strict privacy laws have contributed to the deprecation of third-party cookies, making brands’ investment in authenticated first-party data for customer acquisition and conversion more important than ever. It’s vital that insurers partner with technology providers that prioritize a privacy-first, person-based approach.

3. Start with Key Use Cases and Determine KPIs

Before integrating a CDP into your marketing technology stack, it’s important to define your primary use cases and how success will be measured.

“One thing that’s really important to keep in mind is that technology decisions should always begin from a business strategy point of view,” said Robyn Croll, Vice President of Customer Insights at Goose Digital. “[This] will allow you to focus on things like growing customer value or reducing churn and improving retention rates … whether you are in the B2B or B2C — or even the B2B2C space — it’s equally important to start by identifying those key business drivers.”

The No. 1 reason for failed CDP deployments is not having established initial use cases or overcomplicating them, according to executive leaders. Understanding which use cases are most important to your business priorities will help you evaluate different CDP vendors and make the right choice, not to mention simplify implementation and speed up time to value.

4. Gain Insights With a Single Source of Truth

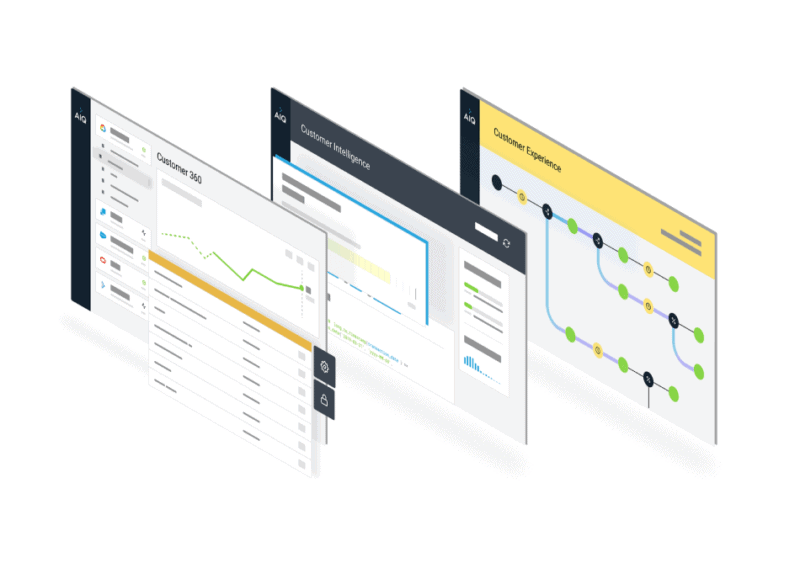

No matter what your objectives are, you can’t optimize operations without being able to effectively test different tactics and analyze performance.

“If you can’t measure it, you can’t improve it,” Phipps said.

With a CDP, data that was previously siloed is now available through a user-friendly interface, enabling business users across the organization to collaborate around accurate intelligence and identify trends or anomalies.

“The power and additional benefits of the CDP from a reporting perspective is that all this siloed data is no longer siloed,” Croll said.

Insurance companies face significant challenges related to data complexity, governance requirements and organizational silos. Oftentimes, insurance providers invest in costly manual processes to improve customer understanding, but a lack of scalability, flexibility and connectivity lead to suboptimal results.

Now more than ever, insurance companies are investing in customer experience via their marketing technology stacks. And data shows that property and casualty insurers who invest in marketing and sales technology can increase top-line growth by up to 40%.

Check out the full webinar featuring OnStar Insurance and Goose Digital to learn more about achieving customer centricity using a CDP.

Learn More

Check out our B2B CDP solution sheet to see how you can obtain an integrated, real-time view into all consumer behaviors and deliver targeted experiences across the full customer lifecycle.